2026 Tax Deadlines for Retirees: The Simple Calendar (and the Traps to Avoid)

Introduction

For many retirees, taxes don’t feel urgent anymore.

There’s no paycheck withholding to monitor. No employer reminding you of deadlines. And in many cases, income arrives automatically from Social Security, pensions, or investment accounts.

That’s exactly why tax deadlines can quietly become more important in retirement—not less.

Missing or misunderstanding a deadline can lead to:

- Penalties or underpayment issues

- Surprise tax bills

- Medicare premium increases

- Cash-flow problems later in the year

Below is a clear, plain-English overview of the 2026 tax deadlines retirees should be aware of, along with why each one matters in real life—not just on paper.

January 15, 2026 – Final Estimated Tax Payment for 2025

If you make quarterly estimated tax payments, the final payment for 2025 is due January 15, 2026.

This often applies to retirees with:

- Portfolio income

- RMDs without withholding

- Pension income

- Roth conversion income

- Rental or business income

Why this matters for retirees

Unlike working years, retirees often don’t have automatic withholding unless it’s intentionally set up. Missing this payment can trigger underpayment penalties, even if you pay your taxes in full later.

Many retirees assume they can “settle up” in April. That’s not always true.

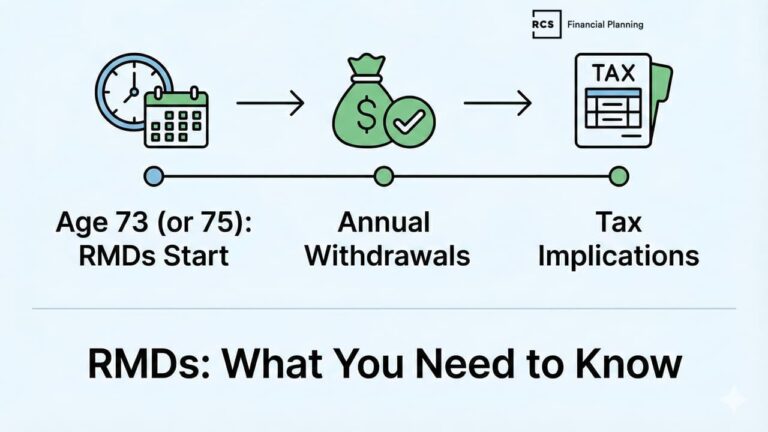

April 1, 2026 – Required Minimum Distribution (RMD) Deadline for New Retirees

If you turned 73 in 2025 and did not take your first Required Minimum Distribution (RMD) that year, the deadline is April 1, 2026.

Why this matters

Delaying your first RMD can:

- Push two RMDs into the same tax year

- Increase taxable income

- Trigger higher Medicare premiums (IRMAA)

- Affect taxation of Social Security benefits

This is one of those decisions that looks harmless but can create unexpected downstream consequences.

April 15, 2026 – Individual Tax Return Deadline

April 15 remains the standard deadline to file your 2025 federal tax return, unless extended.

Key reminders for retirees

- Filing an extension extends time to file, not time to pay

- Any taxes owed must still be paid by April 15

- Extensions can be helpful for planning—but only when used intentionally

This deadline often interacts with:

- RMD timing

- Roth conversion decisions

- Capital gains planning

June 15, 2026 – Second Quarter Estimated Tax Payment

If you’re making estimated payments, the second quarter payment for 2026 is due June 15.

Why this trips retirees up

Estimated payments aren’t evenly spaced throughout the year. This deadline comes sooner than many expect—especially after a spring tax filing rush.

Without planning, this can lead to:

- Cash-flow strain

- Missed payments

- Accidental underpayment

September 15, 2026 – Third Quarter Estimated Tax Payment

The third estimated tax payment for 2026 is due September 15.

This often coincides with:

- Late-summer portfolio withdrawals

- Additional RMD planning

- Capital gains realization

For retirees, September is often when tax planning either gets proactive—or gets rushed.

October 15, 2026 – Extended Tax Filing Deadline

If you filed an extension, October 15 is your final deadline to file your return.

Important clarification

By this point:

- All taxes should already be paid

- Extensions should be used for accuracy and planning, not delay

For retirees coordinating taxes, income, and Medicare costs, extensions can be valuable—but only when integrated into a broader plan.

December 31, 2026 – Year-End Planning Deadline

While not a filing deadline, December 31 is often the most important tax planning cutoff for retirees.

By year-end, decisions must be finalized for:

- RMDs

- Roth conversions

- Capital gains or losses

- Charitable giving strategies

- Income coordination for Medicare and Social Security

Once the calendar turns, many planning opportunities disappear.

Why Tax Deadlines Matter More in Retirement

In retirement, taxes become:

- Less automatic

- More interconnected

- More impactful on cash flow and healthcare costs

Small missteps can ripple into:

- Higher Medicare premiums

- Lost tax-planning opportunities

- Forced withdrawals at the wrong time

This is why guessing—or relying on last-minute adjustments—often backfires.

Practical Takeaways for Retirees

If you’re navigating taxes in retirement, a few grounded steps can help:

- Know which deadlines apply to your income sources

- Coordinate tax payments with portfolio withdrawals

- Review withholding and estimated payments annually

- Plan taxes before year-end, not after

Tax planning in retirement is less about forms—and more about timing and coordination.

Next Steps

If you’re unsure whether your tax strategy is aligned with your retirement income and Medicare costs, a second look can be helpful.

You can:

- Schedule an introductory call to review how taxes fit into your retirement income plan, or

- Download our IRMAA guide if you want to better understand how tax decisions affect Medicare premiums.

Clear deadlines—and a coordinated plan—can prevent unnecessary surprises.

Ready for clarity and confidence in your Retirement plan?

30 minutes · No cost · No obligation

This material is provided for educational, general information, and illustration purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, or investment advisory services. This content is published by an SEC-registered investment adviser (RIA) and is intended to comply with Rule 206(4)-1 under the Investment Advisers Act of 1940. No statement in this article should be construed as an offer to buy or sell any security or digital asset. Past performance is not indicative of future results.