The Widow Penalty: Why Losing a Spouse Often Triggers a Financial Shock

Introduction

Losing a spouse is one of the most difficult transitions anyone can face.

What many people don’t expect is that, alongside the emotional loss, there is often a financial shock—sometimes arriving months or even years later.

This is known as the widow penalty.

It’s not a single tax, fee, or rule. Instead, it’s the combined effect of lower income and higher taxes that frequently follows the death of a spouse. And for many widows, it comes as a surprise.

Understanding how the widow penalty works—and planning for it ahead of time—can help reduce unnecessary stress during an already challenging period.

What Is the Widow Penalty?

The widow penalty refers to the financial squeeze that often occurs after one spouse dies, when:

- Household income drops

- Tax rates increase

- Certain benefits are reduced or lost

In many cases, the surviving spouse ends up paying more in taxes on less income.

This isn’t due to a mistake or poor decisions. It’s largely the result of how tax laws and retirement benefits are structured.

Why Income Often Drops After a Spouse Dies

For most married couples in retirement, income comes from multiple sources. When one spouse passes away, at least one of those income streams typically changes.

Common examples include:

- Social Security: The surviving spouse generally keeps the higher of the two benefits—not both.

- Pensions: Some pensions reduce or stop entirely unless a survivor option was elected.

- Portfolio withdrawals: Income may need to be adjusted to preserve long-term sustainability.

As a result, household income often falls by 30–50%, even though many expenses remain unchanged.

Why Taxes Often Go Up at the Same Time

At the same moment income declines, taxes frequently increase.

Here’s why:

Filing Status Changes

Widows typically move from Married Filing Jointly to Single after a short transition period. The single tax brackets are narrower, which means income reaches higher tax rates sooner.

Loss of Deductions and Thresholds

Many tax thresholds—including those tied to Medicare premiums and Social Security taxation—are lower for single filers.

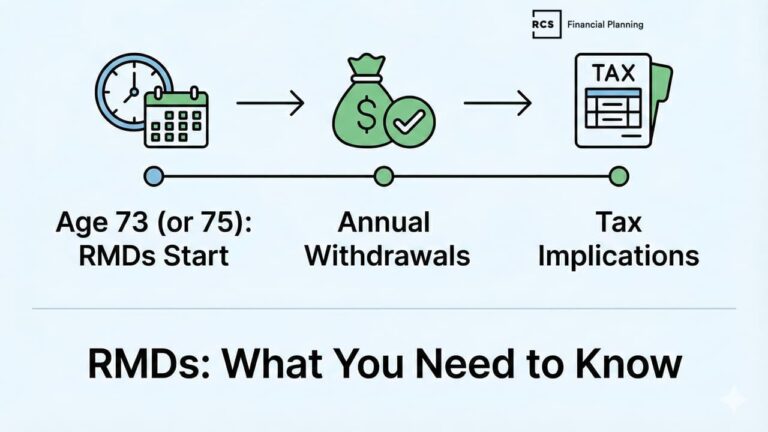

Required Minimum Distributions (RMDs)

RMDs don’t decrease just because income has fallen. In some cases, they can actually rise as accounts are consolidated.

The result is a painful mismatch: lower income taxed at higher marginal rates.

Not sure if you’re missing anything in your retirement plan?

These 3 free checklists cover retirement planning, tax strategies, and important financial deadlines—so you can make informed decisions with confidence.

Why the Widow Penalty Is Often Missed

The widow penalty is rarely addressed early because:

- Couples focus on lifetime benefit maximization, not survivor outcomes

- Planning often assumes “everything continues as is”

- Advisors may treat taxes as a filing issue, not a long-term strategy

In practice, this means many widows are forced to react after the penalty appears—when options are more limited.

Planning Ahead: What Can Reduce the Impact

While the widow penalty can’t be eliminated entirely, its impact can often be reduced with thoughtful planning before it occurs.

Common planning considerations include:

Coordinating Social Security Decisions

Claiming strategies should consider survivor benefits—not just lifetime totals.

Tax Planning While Married

Strategic Roth conversions or income smoothing during joint-filing years can reduce future tax pressure.

Reviewing Pension Elections

Survivor options may lower income today but protect stability later.

Stress-Testing Retirement Income

Plans should model what happens after the loss of a spouse—not just while both are living.

This kind of planning isn’t about predicting the future. It’s about reducing vulnerability.

Why This Matters Even If You’re Healthy

Many couples avoid this topic because it feels uncomfortable—or premature.

But in retirement planning, hope is not a strategy.

Addressing the widow penalty early doesn’t mean expecting the worst. It means ensuring that if life changes, the surviving spouse isn’t left scrambling.

In our experience, widows who have clarity and preparation experience:

- Fewer financial surprises

- More confidence making decisions

- Less pressure to act quickly

Practical Takeaways

If you’re married and approaching—or already in—retirement:

- Understand how income changes after one spouse dies

- Review how taxes shift under single filing status

- Evaluate survivor benefits, not just household income

- Build flexibility into your retirement income plan

These steps don’t require drastic action—but they do require awareness.

Next Steps

If you’d like a clearer picture of how the widow penalty could affect your situation, a second look may be worthwhile.

You can:

- Schedule an introductory call to review survivor income and tax implications, or

- Read our related article on Social Security benefits to better understand benefit coordination

Planning ahead won’t remove the emotional weight of loss—but it can remove unnecessary financial stress.

Ready for clarity and confidence in your Retirement plan?

30 minutes · No cost · No obligation

This material is provided for educational, general information, and illustration purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, or investment advisory services. This content is published by an SEC-registered investment adviser (RIA) and is intended to comply with Rule 206(4)-1 under the Investment Advisers Act of 1940. No statement in this article should be construed as an offer to buy or sell any security or digital asset. Past performance is not indicative of future results.