How Qualified Charitable Distributions Can Cut Your Tax Bill While Supporting Your Favorite Causes

If you’re charitably inclined and over age 70½, you may be overlooking one of retirement’s most powerful—and underused—tax planning strategies. A Qualified Charitable Distribution (QCD) allows you to donate directly from your IRA to charity, satisfying your required minimum distribution while keeping that money out of your taxable income entirely.

For many retirees, this isn’t just about making a donation more tax-efficient. A properly executed QCD can reduce your adjusted gross income (AGI), which creates a cascade of potential tax benefits: lower Medicare premiums, preserved deductions and credits, reduced taxes on Social Security benefits, and more favorable tax brackets. The real question isn’t whether QCDs are worthwhile—it’s whether you’re using them strategically enough to capture all the benefits they can provide.

In this comprehensive guide, you’ll learn exactly how QCDs work, who can benefit most from them, the 2025 rule updates you need to know, and a strategic framework for incorporating QCDs into your broader retirement tax plan. We’ll also look at a real-world example showing how a $6,000 QCD delivered nearly $4,000 in combined federal and state tax savings—far more than a standard charitable deduction would have provided.

Understanding the Qualified Charitable Distribution Strategy

What Is a QCD and How Does It Work?

A Qualified Charitable Distribution is a direct transfer of funds from your traditional IRA to an eligible 501(c)(3) charity. Unlike a normal IRA withdrawal—which counts as taxable income—a QCD is excluded from your gross income entirely. This direct-to-charity payment can satisfy all or part of your required minimum distribution (RMD) for the year.

The mechanics are straightforward but must be followed precisely. You contact your IRA custodian and request a distribution check made payable directly to your chosen charity. You never touch the money yourself. The charity receives the funds, you receive a written acknowledgment for your records, and your IRA custodian reports the distribution on Form 1099-R. For 2025, the IRS has introduced a new Distribution Code “Y” in box 7 of Form 1099-R specifically to identify QCDs, making reporting clearer for both taxpayers and the IRS.

Who Can Make a QCD?

You must be at least 70½ years old when the distribution is made. This is an important distinction from the RMD age, which is now 73 for most people. You can begin making QCDs before you’re required to take RMDs, giving you several years of potential tax planning opportunities.

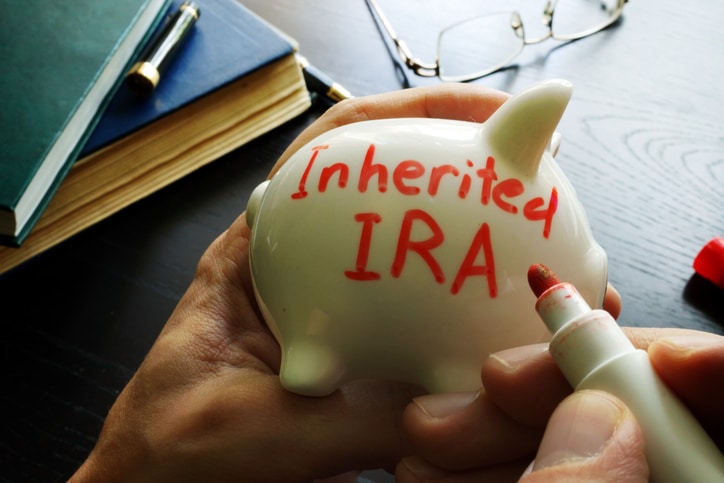

QCDs can only be made from traditional IRAs and inherited IRAs. You cannot make a QCD from an employer plan like a 401(k), SEP IRA (while still receiving contributions), or SIMPLE IRA (during the first two years). If you have retirement funds in these accounts and want to use the QCD strategy, you’ll first need to roll them into a traditional IRA.

The 2025 QCD Limits You Need to Know

For 2025, the IRS has adjusted the QCD limits for inflation. The annual aggregate QCD exclusion limit has increased to $108,000 per person. If you’re married, your spouse can also make QCDs up to $108,000 from their own IRA, for a combined potential of $216,000 in tax-free charitable giving.

Additionally, there’s a separate one-time QCD option allowing you to fund certain split-interest charitable arrangements—specifically, a charitable remainder trust or charitable gift annuity funded entirely by QCDs. The 2025 limit for this special one-time election is $54,000. This advanced strategy can provide you with income while still achieving charitable and tax planning goals, though it requires careful legal and financial coordination.

Why QCDs Are More Powerful Than Standard Charitable Deductions

The AGI Advantage: Beyond the Tax Deduction

Most retirees have heard that charitable giving can reduce taxes, but standard itemized charitable deductions work differently—and often less effectively—than QCDs. When you make a traditional charitable contribution, you first include your full IRA distribution in your income, increasing your AGI. Then, if you itemize deductions (rather than taking the standard deduction), you can deduct your charitable gift.

With the standard deduction at $32,300 for married couples filing jointly in 2025 ($16,150 for single filers), many retirees don’t itemize at all. Even if you do itemize, your charitable deduction occurs “below the line”—it reduces taxable income but doesn’t change your AGI.

A QCD works completely differently. The distribution never appears in your income in the first place. This keeps your AGI lower, which matters tremendously because AGI is the trigger point for dozens of tax benefits, phase-outs, and surcharges in retirement.

The Hidden Tax Benefits of Lower AGI

When a QCD reduces your AGI, several additional tax benefits often come into play:

Medicare IRMAA Thresholds: Income-Related Monthly Adjustment Amounts increase your Medicare Part B and Part D premiums when your modified adjusted gross income exceeds certain levels. For 2025, these IRMAA surcharges begin at $106,000 for single filers and $212,000 for married couples. A QCD can help you stay below these thresholds or move into a lower surcharge bracket, potentially saving thousands of dollars annually in Medicare premiums.

Social Security Taxation: Up to 85% of your Social Security benefits can be taxable depending on your combined income (AGI plus tax-exempt interest plus half of Social Security benefits). Lowering your AGI through QCDs can reduce the taxable portion of your Social Security benefits.

Capital Gains Tax Rates: The 0% long-term capital gains rate applies up to certain taxable income thresholds. Keeping your AGI lower with QCDs can help you remain in the 0% bracket, allowing you to harvest capital gains completely tax-free.

State Tax Credits and Deductions: Many states offer senior tax credits or enhanced deductions that phase out at specific AGI levels. As we’ll see in a real example below, these state-level benefits can sometimes provide even larger savings than federal tax benefits.

Net Investment Income Tax: If your AGI exceeds $200,000 (single) or $250,000 (married filing jointly), you may be subject to the 3.8% Net Investment Income Tax on certain investment income. QCDs can help you avoid crossing this threshold.

A Real-World Example: When $6,000 Only “Costs” $2,103

Let me share a recent planning situation that illustrates the extraordinary power of strategic QCD planning—particularly when federal and state tax rules align.

A married couple in their early 70s had adjusted gross income of $155,000 before considering any charitable giving. They were charitably inclined and had been making annual cash donations to their church and other causes. Their marginal federal tax bracket was 22%, and they were Maryland residents paying a 5.75% state income tax rate along with a 2.85% Anne Arundel County tax rate.

Here’s where it gets interesting. At $150,000 of AGI, two critical tax benefits were at stake:

- Federal: An enhanced senior standard deduction worth up to $12,000 in additional deductions that begins phases out above $150,000 AGI

- Maryland: A $1,750 senior tax credit that completely disappears at exactly $150,000 of AGI (a hard cliff)

At $155,000 of AGI, this couple was above the $150,000 threshold. They were losing the Maryland senior credit entirely and seeing their federal enhanced senior deduction phase out. When they made a $6,000 QCD instead of their usual cash donation, here’s what happened:

Federal Tax Impact:

- The QCD reduced their AGI to $149,000

- This brought them fully under the $150,000 threshold, restoring the complete $12,000 enhanced senior deduction

- Federal tax savings: $1,456

Maryland State Tax Impact:

- Their AGI now qualified for the full $1,750 senior credit (previously $0)

- Combined with the AGI reduction itself lowering their Maryland taxable income

- Maryland tax savings: $2,441

Total Tax Savings: $3,897

Net Cost of Charitable Gift: Only $2,103 out of pocket ($6,000 – $3,897)

By using a QCD instead of writing a check to charity, this couple’s $6,000 donation effectively cost them only 35 cents on the dollar. The strategic value wasn’t just about the federal deduction—it was about understanding how a single AGI threshold triggered benefits at both the federal and state levels simultaneously.

This example demonstrates why tax planning in retirement requires looking at the entire picture, not just federal brackets and deductions. Many states have senior credits, pension exclusions, or property tax relief programs that phase in or out based on AGI. When these align with federal AGI thresholds, a well-timed QCD can unlock multiple benefits at once.

Not sure if you’re missing anything in your retirement plan?

These 3 free checklists cover retirement planning, tax strategies, and important financial deadlines—so you can make informed decisions with confidence.

Strategic Framework: How to Use QCDs Most Effectively

Step 1: Determine Your Optimal QCD Timing

While you can begin making QCDs as early as age 70½, the strategic timing depends on your specific situation:

Before RMDs Begin (Ages 70½ to 72): If you’re charitably inclined and have other income sources pushing you into higher brackets or causing AGI-related issues, QCDs can be valuable even before you’re required to take RMDs. You’re voluntarily taking IRA distributions—but doing so in the most tax-efficient way possible.

After RMDs Begin (Age 73+): Once RMDs are mandatory, QCDs become even more attractive. Rather than taking your RMD as taxable income and then writing a check to charity, you’re accomplishing both goals in one tax-efficient move. Your RMD is satisfied, your favorite causes are supported, and the distribution never appears as income.

During High-Income Years: If you have a year with unusually high income—perhaps from a Roth conversion, business sale, or large capital gain—QCDs can help offset some of that income and reduce the tax impact.

Step 2: Identify Your AGI “Cliffs” and Thresholds

The most sophisticated QCD planning involves identifying the specific AGI levels that trigger tax consequences for your situation. Work through this checklist:

- What are the IRMAA thresholds for your filing status, and how close is your projected income?

- Do you live in a state with senior tax credits or enhanced deductions that phase in or out at specific AGI levels?

- Will you be harvesting capital gains? If so, what’s the AGI threshold to stay in the 0% capital gains bracket?

- How much of your Social Security is currently taxable, and could lowering AGI reduce that percentage?

- Are you close to the thresholds for the Net Investment Income Tax or the Alternative Minimum Tax?

Once you’ve mapped out your specific AGI sensitivities, you can determine the optimal QCD amount—not just based on your charitable intentions, but on the tax benefit optimization as well.

Step 3: Execute QCDs Properly and Keep Documentation

The IRS is strict about QCD procedures. Follow these execution guidelines carefully:

Use Direct Transfers Only: The distribution must go directly from your IRA custodian to the charity. If you receive the money and then donate it, it doesn’t qualify as a QCD. Most custodians have specific QCD request forms or procedures.

Verify Charity Eligibility: The charity must be a 501(c)(3) organization eligible to receive tax-deductible contributions. Donor-advised funds, private foundations, and supporting organizations don’t qualify for QCDs. When in doubt, confirm the charity’s eligibility.

Complete by December 31: QCDs must be completed by December 31 of the tax year to count for that year. Don’t wait until late December—mail delays can cause problems. If satisfying your RMD with a QCD, give yourself plenty of time.

Obtain Written Acknowledgment: Request a contemporaneous written acknowledgment from the charity confirming the donation amount and that no goods or services were received in exchange. Keep this with your tax records.

Report Correctly: Your Form 1099-R will show the distribution in box 1. On your tax return, you’ll report the total IRA distribution but indicate that the taxable amount is reduced (or zero) due to a QCD. For 2025, the new Code “Y” in box 7 helps identify the distribution as a QCD, but you still need to properly report it on your return.

Step 4: Coordinate QCDs with Your Broader Tax Strategy

QCDs don’t exist in isolation—they’re one tool in your retirement tax planning toolkit. Consider how QCDs interact with other strategies:

Roth Conversions: In years when you’re doing Roth conversions to increase taxable income strategically, you might reduce or skip QCDs to maximize the “space” in lower tax brackets. Conversely, in high-income years, QCDs can help offset some of that income.

Tax Loss Harvesting: If you’ve harvested capital losses that are reducing your current income, you might have less need for QCD’s income-reducing benefits that year.

Charitable Bunching: In years when you’re not making QCDs, you might bunch multiple years of charitable contributions into a single year to exceed the standard deduction threshold and itemize. QCDs offer an alternative: consistent annual tax-efficient giving without needing to itemize.

Social Security Timing: If you’re delaying Social Security to age 70, your income may be lower in your mid-to-late 60s. This might be an ideal time for Roth conversions rather than QCDs. Once Social Security begins and your income rises, QCDs become more attractive.

Common QCD Mistakes and Misconceptions

Mistake #1: Assuming You Need to Itemize to Benefit

Many retirees mistakenly believe they need to itemize deductions to benefit from charitable giving. This confusion stems from the traditional charitable deduction rules. With QCDs, itemizing is irrelevant. You benefit whether you take the standard deduction or itemize because the QCD excludes income rather than creating a deduction.

Mistake #2: Making Cash Donations When QCDs Would Be Better

Some retirees continue writing checks to charity from their checking accounts while simultaneously taking taxable IRA distributions to cover living expenses. This is backwards. If you’re taking IRA distributions anyway and you’re charitably inclined, use QCDs first up to your charitable giving amount. Take additional IRA distributions beyond that only if needed.

Mistake #3: Forgetting About State Tax Implications

As our real-world example illustrated, state tax benefits can sometimes exceed federal benefits. Don’t focus exclusively on your federal tax picture. Review your state’s senior tax credits, pension exclusions, and property tax relief programs. Many of these are AGI-sensitive, making QCDs especially valuable.

Mistake #4: Poor Timing and Documentation

Taking a regular IRA distribution in November and then making a cash donation in December doesn’t qualify as a QCD. The direct transfer must occur, and the documentation must be proper. Many people also wait until late December and run into processing delays. Start your QCD planning in October or November to allow for any custodian delays.

Mistake #5: Not Maximizing the Strategy Once RMDs Begin

If your RMD is $50,000 and you’re charitably inclined to give $10,000 annually, make sure the first $10,000 of your RMD comes out as a QCD. Some retirees take their full RMD as taxable income early in the year and then make separate QCDs later. While this still works, it’s less clean and can create confusion with RMD tracking.

Advanced Consideration: Split-Interest QCDs

For retirees with larger charitable intentions and a desire for income, the one-time split-interest QCD deserves mention. This allows you to fund a charitable remainder trust (CRT) or charitable gift annuity (CGA) using QCD money—up to $54,000 in 2025.

A CRT or CGA provides you (and potentially your spouse) with income for life or a term of years, with the remainder going to charity after your death. Normally, funding these vehicles with IRA money would require taking a taxable distribution first. The split-interest QCD rules allow you to fund them directly from your IRA without recognizing income.

This strategy is complex and requires working with qualified legal and financial professionals. The CRT or CGA must be funded entirely with QCDs (no other contributions allowed), and specific structural requirements must be met. But for the right situation—perhaps a retiree in their 70s who wants to leave a legacy gift to charity while supplementing their current income—it can be a powerful tool.

Practical Steps You Can Take Now

If you’re age 70½ or older and charitably inclined, here are immediate actions to consider:

- Calculate your current year’s projected AGI and identify any thresholds or cliffs where QCDs could provide extra benefit (IRMAA levels, state tax credits, Social Security taxation, etc.).

- Review your charitable giving patterns from the past few years. How much have you donated annually? Are you donating cash while also taking IRA distributions?

- Contact your IRA custodian and ask about their QCD procedures. Some require special forms, while others allow QCD requests through their online platforms. Understanding the process now prevents December rush mistakes.

- Make a list of your eligible charities and confirm they’re 501(c)(3) organizations (most churches, schools, hospitals, and traditional charities qualify; donor-advised funds do not).

- Discuss with your tax advisor how QCDs fit into your broader tax plan for this year and future years, especially in relation to Roth conversions, capital gains harvesting, and Social Security timing decisions.

Key Takeaways

- QCDs are available starting at age 70½ from traditional and inherited IRAs, with a 2025 annual limit of $108,000 per person

- QCDs reduce your AGI, not just your taxable income, which can trigger multiple cascading tax benefits

- QCDs can satisfy your required minimum distribution while keeping that money out of your taxable income entirely

- State tax benefits from lower AGI can sometimes exceed federal benefits, especially with senior credits and enhanced deductions

- Proper execution is critical: direct transfer to an eligible charity, completed by December 31, with written acknowledgment

- Strategic QCD planning considers your AGI thresholds, coordinates with other tax strategies, and maximizes total tax benefit

Ready to Optimize Your Retirement Tax Strategy?

Qualified Charitable Distributions represent just one piece of comprehensive retirement tax planning. The most valuable opportunities often emerge when you coordinate QCDs with Roth conversions, Social Security timing, capital gains management, and state-specific tax strategies—all while keeping your AGI in the sweet spot that maximizes benefits and minimizes surcharges.

If you’re approaching retirement or already retired with significant IRA assets and charitable intentions, it’s worth having a detailed conversation about how QCDs fit into your personalized plan.

The difference between a standard approach and strategic retirement tax planning can easily mean tens of thousands of dollars over your retirement years. Let’s make sure you’re capturing every opportunity available to you.

Ready for clarity and confidence in your Retirement plan?

30 minutes · No cost · No obligation

This material is provided for educational, general information, and illustration purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, or investment advisory services. This content is published by an SEC-registered investment adviser (RIA) and is intended to comply with Rule 206(4)-1 under the Investment Advisers Act of 1940. No statement in this article should be construed as an offer to buy or sell any security or digital asset. Past performance is not indicative of future results.