When Can You File for Social Security?

Filing for Social Security

Since President Franklin D. Roosevelt signed the Social Security Act in 1935, the question that has troubled most Americans as they near retirement is:

“When can you file for Social Security and when is the right time to begin receiving Social Security retirement benefits?”

However, despite its commonality, there is no definitive answer to this question, as various personal factors, Congressional policies, and unpredictable future events influence it.

As a result, many families are perplexed when deciding on their Social Security retirement benefits. This article will examine how to strike the appropriate balance for your circumstances.

7 Factors to Consider before you collect benefits

For most people, retirement is the time to enjoy life and relax after years of hard work. But for those nearing their retirement age, one important decision must be made: when and how to file for Social Security benefits.

Filing for Social Security can be confusing due to the variety of rules and regulations, so it is essential that you understand all your options before making a decision that could cost you literally thousands in potential benefits.

Here are 7 factors to consider when determining when to start receiving your Social security benefit.

- Alternate Income Sources: First, and perhaps most obviously, if you have few or no alternate income sources once your paychecks stop, you may not have the luxury of waiting until your full retirement age or until you’re 70. Based on your retirement planning, you may need to start to collect benefits as soon as possible.

- Life Expectancy: To at least break even, if not come out ahead by waiting until your full retirement age or age 70 also assumes you’ll meet or exceed the age the Social Security Administration estimates someone your age and gender is likely to reach, based on the averages. Even if you can afford to wait, you’ll want to determine whether your health, lifestyle, and family history justify doing so.

- Estate Planning: Have you placed a high or low priority on leaving as much money as possible to your heirs and/or favorite charities after you pass? Your preferences here may influence how and from where you’ll spend your inheritable estate, which in turn may influence the timing of your Social Security enrollment.

- Employment: How likely is it you’ll keep working until your full retirement age (FRA)? Once you reach it, you can collect full Social Security benefits, even if you’re still working. But until then, your earnings may reduce your Social Security benefits.

- Marital Status: If you’re married, one of you has probably paid in more, one is likely to live longer, you may retire at different times, and your ages probably differ. All these factors can complicate the equation. You’ll want to consider the timing, rules, and outcomes under various scenarios—such as when and whether to take Social Security as an earner, the spouse of an earner, surviving spouse benefits, or an ex-spouse of an earner—while also factoring in whether you and/or your spouse are still working prior to your full retirement age, as described above. Ideal start dates for one scenario may not be ideal for another.

- Other Circumstances: Beyond your marital status, there are other factors that may influence your timing decisions if they apply to you—such as if you’re a business owner, you live abroad, you qualify for Social Security Disability benefits, or your children qualify for Social Security benefits under your account.

- Income Taxes: We find many pre-retirees don’t realize that up to 85% of their Social Security income may be taxable. Your annual Social Security income also figures into your modified adjusted gross income (MAGI), which can push you past thresholds for incurring Medicare surcharges (beginning at age 65, based on your MAGI from two years prior). The bottom line, broad tax planning may influence or delay your timing as well.

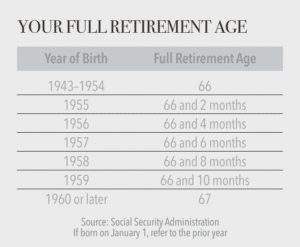

What is Full Retirement Age for Social Security Benefits

For Social Security planning purposes, you reach full retirement age (FRA) between ages 66–67, depending on the year you were born.

However, you can generally draw Social Security retirement benefits as early as age 62 (with the lowest available monthly benefit payments) or as late as age 70 (with the highest available monthly benefit payments).

Should I Wait Until Full Retirement Age to Apply for Social Security?

Retirees are often advised to wait until full retirement age or age 70 to take Social Security retirement benefits. In raw dollars, waiting to take your Social Security benefit until at least full retirement age (or later) usually provides a higher benefit amount and more money for many families.

Plus, these days, many of us choose to work beyond the traditional retirement age and into our 70s and beyond. Some analyses have even factored in the cost of spending down other assets while you wait rather than using them for continued savings and investment growth. The conclusion is the same.

However, you’re not “many families.” You’re your family. Your personal and practical circumstances may mean this general rule of thumb won’t point to your best choice.

Can you collect Social Security at 62 and still work?

You may collect Social Security benefits at age 62 and work. However, it’s important to understand the Social Security earnings penalty and how it affects your benefit amount.

The Social Security earnings penalty is an important aspect of Social Security benefits that can affect individuals who start collecting benefits before their full retirement age and continue to work and earn income.

The earnings threshold for the year 2023 is $18,960, and if an individual earns more than this amount while receiving benefits before their full retirement age, their benefits will be reduced by $1 for every $2 earned above the threshold.

This penalty is designed to encourage individuals to wait until their full retirement age to start receiving benefits, as they will no longer be subject to the penalty and can earn as much income as they like without having their benefits reduced.

It’s important to note that the earnings penalty only applies to earned income, such as wages or self-employment income, and does not apply to other sources of income, such as investments or pensions.

How many months ahead should I apply for Social Security benefits?

When it comes to the application process for retirement benefits, the Social Security Administration recommends applying three months before you want to receive benefits. However, you can apply up to four months in advance of when you want to receive benefits. This means that if you want your retirement benefits to start in January (first payment), you can apply as early as September of the previous year. Applying early can help ensure that you receive your retirement benefits on time and that you receive the full amount you are entitled to.

Maximizing Benefits

Clearly, there’s a lot to think about when deciding when to start taking Social Security. Whether you’re going it alone or with a financial planner, here’s one piece of advice that should help:

Control what you can. Let go of what you can’t.

What do we mean by that? There are many known factors you can include in your Social Security planning process. You know your marital status. You can access your Social Security account and/or use a calculator to estimate your benefits.

You can make educated guesses about your life expectancy, how long you’ll work, and so on. Also, if you delay taking Social Security past your full retirement age, you may be able to change your mind … to a point. You can file to collect up to six months of retroactive benefits if you end up needing the income sooner than planned.

You can use the monthly benefit of all this planning information and more to make reasonable assumptions and timely decisions about when to take your Social Security.

After that, we recommend going easy on yourself if (or, more realistically, when) some of your plans don’t go as planned. Come what may, you’ve done your best.

Instead of channeling energy into regretting good decisions, use it to make judicious adjustments whenever new assumptions arise. By consistently focusing on what we know rather than what we hope or fear, we remain best positioned to shift course as warranted in the face of adversity.

Conclusion

Whether you’re planning to file for Social Security or you’re already drawing it, we relish the opportunity to help you and your family make good choices about when and how to manage your available options. We hope you’ll contact us today to learn more.

Ready for clarity and confidence in your Retirement plan?

30 minutes · No cost · No obligation

This material is provided for educational, general information, and illustration purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, or investment advisory services. This content is published by an SEC-registered investment adviser (RIA) and is intended to comply with Rule 206(4)-1 under the Investment Advisers Act of 1940. No statement in this article should be construed as an offer to buy or sell any security or digital asset. Past performance is not indicative of future results.