What is the Best 529 Plan for Maryland Residents

The Maryland 529 Plan

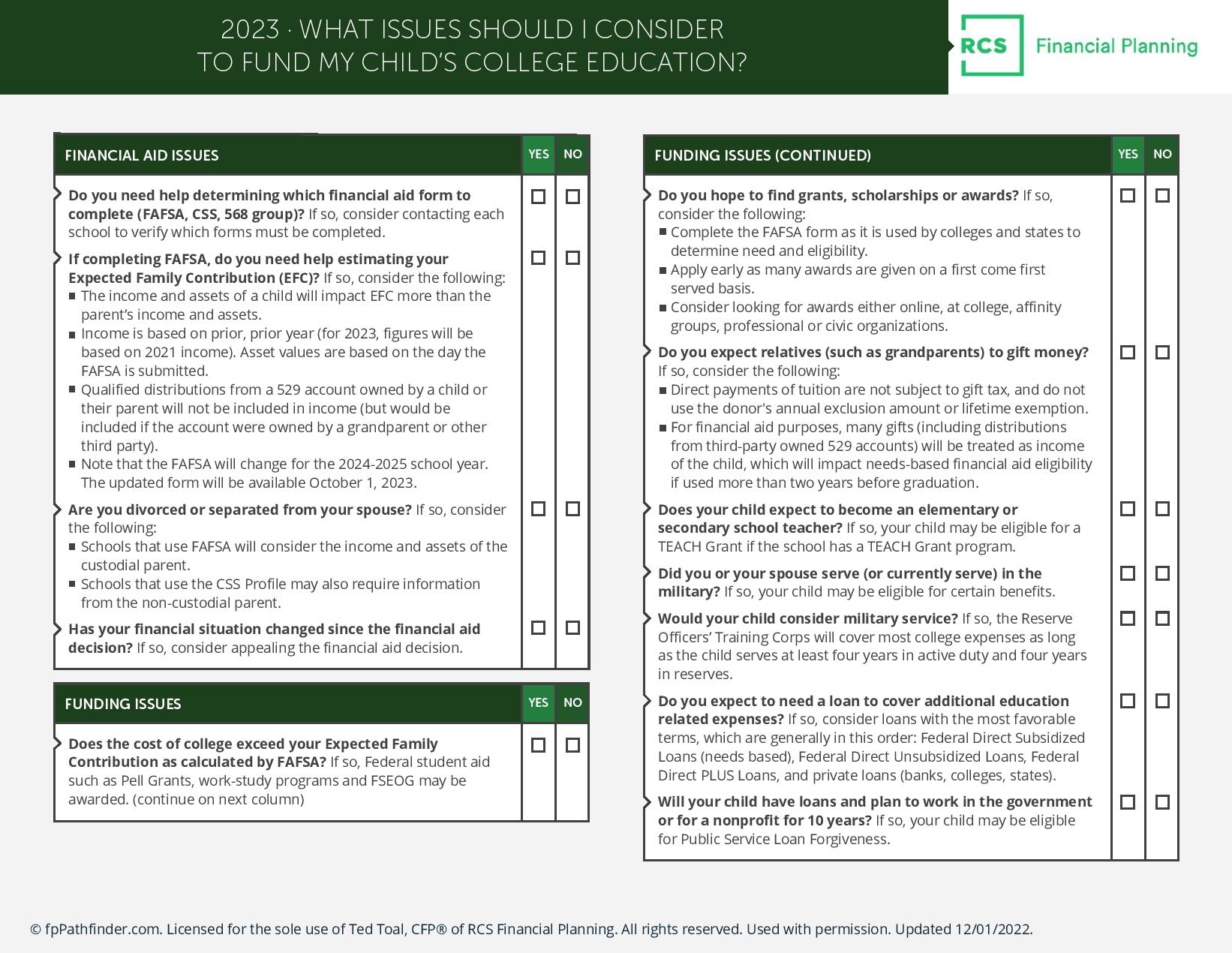

Here at RCS Financial Planning, we often receive questions about the best 529 plan for Maryland residents. In this comprehensive guide will help you understand your options and make an informed decision about saving for your child’s education.

Understanding 529 plans

Introduced in 1996, 529 plans are state-sponsored savings programs designed to make college savings more manageable and appealing. Key points to remember:

- Plans offer tax advantages and flexible investment options

- Each state offers its own 529 plan(s)

- Funds can be used at any eligible educational institution in the United States

The Maryland 529 Investment Plan: A Top Choice for Residents

For Maryland residents, the Senator Edward J. Kasemeyer College Investment Plan, managed by T. Rowe Price, stands out as an excellent option. Here’s why:

- Investment Options: The plan offers a range of portfolios managed by T. Rowe Price, a respected investment firm.

- Strong Performance: Morningstar rated it a Silver Plan in 2023, indicating reasonable fees, strong investment choices, and capable oversight.

- Tax Benefits: Contributions up to $2,500 per beneficiary, per taxpayer are deductible from Maryland state income tax.

- State Contribution Program: Some residents may qualify for a $500 state contribution through the Save4College State Contribution Program.

Maryland 529 Plan Fees

The Maryland 529 Investment Plan offers competitive fees:

UNLOCK THE SECRETS TO FUNDING YOUR CHILD’S COLLEGE EDUCATION

Secure Your Family’s Academic Future

Overwhelmed by the complexities of college funding? Our FREE guide reveals the 5 key strategies to maximize your child’s educational opportunities, highlights the 3 common pitfalls to sidestep, and shows you how to navigate financial aid like a pro. Don’t let confusion cost you thousands in potential savings and aid—download your guide today and take the first step towards a brighter future for your family!

- Program management fee: 0.10%

- Fund fees: Range from 0.06% to 0.63%

These fees are reasonable compared to many broker-sold plans, which often have higher costs and may include commission payments.

Understanding Advisor Recommendations for Out-of-State 529 Plans

At RCS, we are fiduciary financial advisors, and we believe in transparent, client-first recommendations. However, not all financial professionals operate under the same standards. Here’s an in-depth look at why some advisors might recommend out-of-state 529 plans to Maryland residents, despite the apparent benefits of the in-state option:

Compensation Structures and Conflicts of Interest

- Commission-Based Recommendations: Many financial advisors work on a commission basis. The Maryland 529 Investment Plan is directly sold to consumers and doesn’t offer commissions, potentially influencing some advisors to recommend out-of-state plans that do provide compensation.

- Fee-Only vs. Commission-Based Advising: Understanding the difference between fee-only (fiduciary) and commission-based (sometimes referred to as “fee-based,” which is not fee-only) advisors is crucial. Fee-only advisors are legally obligated to put your interests first, while commission-based advisors may have conflicting incentives.

Limited Knowledge or Analysis

- Lack of State-Specific Expertise: Some advisors may not be fully versed in the nuances of every state’s 529 plan offerings, leading to generalized recommendations.

- Insufficient Cost-Benefit Analysis: A thorough analysis should include state tax benefits, fee structures, and long-term investment potential. Some advisors may not perform this comprehensive evaluation.

Perceived Investment Advantages

- Past Performance Focus: An advisor might cite superior past performance of an out-of-state plan. However, it’s crucial to remember that past performance doesn’t guarantee future results.

- Investment Options: Some out-of-state plans may offer a wider range of investment choices. While variety can be beneficial, it’s important to assess whether these options truly provide an advantage over the strong, well-managed portfolios in the Maryland plan.

Misunderstanding of Tax Benefits

- Undervaluing State Tax Deductions: Some advisors may underestimate the value of Maryland’s state tax deduction, particularly if they don’t factor in both state and local tax rates.

- Long-Term Tax Impact: The compounding effect of tax savings over time may be overlooked in short-term analyses.

Corporate Relationships and Pressures

- Preferred Provider Arrangements: Some financial institutions have relationships with specific 529 plan providers, which may influence recommendations.

- Sales Targets: Advisors working for larger institutions may face pressure to meet sales targets for certain products, including specific 529 plans.

How to Protect Yourself and Make Informed Decisions

- Ask About Fiduciary Duty: Inquire whether your advisor is acting as a fiduciary, obligated to put your interests first.

- Request Full Disclosure: Ask for a clear explanation of all fees, commissions, and compensation related to the recommended 529 plan.

- Demand a Comparative Analysis: Request a side-by-side comparison of the Maryland 529 plan with any recommended alternatives, including tax benefits, fees, and investment options.

- Seek Second Opinions: Consider consulting with a fee-only financial advisor or do your own research using reputable sources.

- Understand Your Specific Needs: Your unique financial situation, risk tolerance, and goals should drive the decision, not generic recommendations.

By being informed and asking the right questions, you can ensure that you’re making the best choice for your family’s educational savings goals, whether that’s the Maryland 529 plan or an alternative option.

Maryland 529 plan FAQs

Important Considerations

- Recent Publicity: Negative news about the Maryland 529 plan pertains to the Prepaid College Trust, not the Investment Plan discussed here.

- Tax Benefits: When calculating the value of the tax deduction, consider both state and local tax rates.

- Individual Circumstances: While the Maryland plan is often the best choice for residents, there may be cases where an out-of-state plan is more suitable.

Conclusion

For most Maryland residents saving for higher education, the Maryland 529 Investment Plan offers a compelling combination of tax benefits, strong investment options, and reasonable fees. However, it’s essential to consider your individual circumstances and consult with a fiduciary financial advisor who can provide unbiased recommendations tailored to your specific needs.

Remember, the best 529 plan is one that you’ll consistently contribute to, helping you build a robust college savings fund for your child’s future.

*There is no guarantee Maryland’s 529 Investment Plan will hold a Silver rating with Morningstar

*Fee source: www.savingforcollege.com

This material is provided for educational, general information, and illustration purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, or investment advisory services.

Work With Us

Ready to take the next step?

If you’re interested in our services or exploring a potential collaboration, we’d love to hear from you. Click below to get in touch about professional engagements.