Does Maryland Tax Retirement Income?

Does Maryland Tax Retirement Income?

The short answer is: it depends on the type of retirement income. Maryland taxes some forms of retirement income but also offers various exemptions and exclusions. In this comprehensive guide, we’ll explain how different types of retirement income are taxed in Maryland and provide insights to help you plan your retirement finances effectively.

Overview of Maryland’s Taxation System

To understand how retirement income is taxed in Maryland, it’s crucial to have an overview of the state’s tax structure:

- Income Tax: Maryland uses a progressive tax system. State tax rates range from 2% to 5.75%, depending on income level.

- Local Tax: Each county and Baltimore City charges an additional local tax, ranging from 2.25% to 3.30% of taxable income.

- Other Taxes: Maryland also imposes sales, property, estate, and inheritance taxes.

Taxation of Specific Retirement Income Sources

Social Security Benefits

Good news for retirees: Maryland does not tax Social Security benefits. You can subtract all your Social Security income on your Maryland tax return.

Pensions

Pensions are generally subject to state taxes in Maryland. However, the state offers a pension exclusion (more on this later) that can significantly reduce the taxable amount for eligible retirees.

All military retirees can subtract up to $12,500 of their military pension from their taxable income, and those 55 and older retirees can subtract up to $20,000.

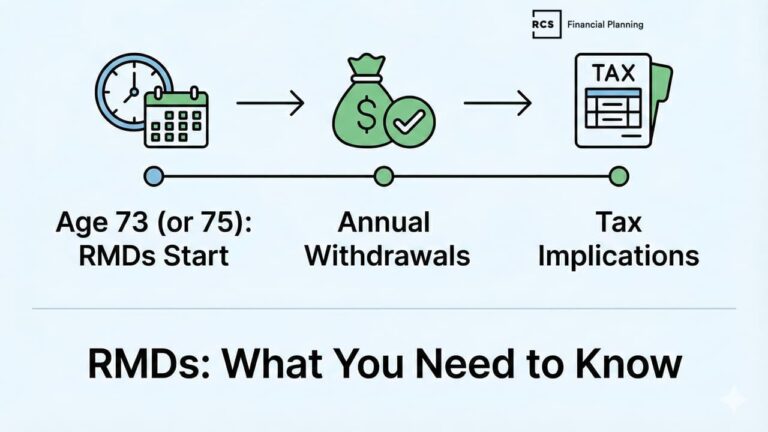

401(k) Plans and IRAs

- 401(k) and 403(b) Plans: Withdrawals are taxable but may be eligible for the pension exclusion.

- Traditional IRAs: Withdrawals are taxable and not eligible for the pension exclusion.

- Roth IRAs: Qualified withdrawals are typically tax-free.

Other Income Sources

Other retirement income sources, such as annuities, rental income, and investment income, are generally subject to Maryland state tax. Some annuity payments may be eligible for the pension exclusion. However, Non-Qualified Annuity distributions are not eligible for the pension exclusion.

Maryland’s Pension Exclusion

Maryland offers a significant tax break through its pension exclusion for those 65 and older:

- 2023 Exclusion Amount: $36,200

- 2024 Exclusion Amount: $39,500

- 2025 Exclusion Amount: $41,200

However, this exclusion considers Social Security benefits and can be reduced or eliminated based on your total income.

Example: Let’s say you’re 65 and receive $20,000 in Social Security benefits and $30,000 from a pension in 2024.

| Line | Description | Amount |

|---|---|---|

| 1 | Net taxable pension and retirement annuity included in your federal AGI | $30,000 |

| 2 | Maximum allowable exclusion | $41,200 |

| 3 | Total Social Security benefits | $20,000 |

| 4 | Tentative Pension exclusion (Subtract line 3 from line 2.) (If less than 0, enter 0) | $21,200 |

| 5 | Exclusion (smaller of line 1 or 4) | $21,200 |

- Your Social Security benefits are not taxed.

- From your $30,000 pension, you can exclude $21,200 ($41,200 – $20,000).

- The remaining $8,800 of your pension would be subject to Maryland income tax.

- Please note line 5: The tentative pension exclusion is the lesser of lines 1 and 4.

Not sure if you’re missing anything in your retirement plan?

These 3 free checklists cover retirement planning, tax strategies, and important financial deadlines—so you can make informed decisions with confidence.

Estate and Inheritance Taxes

Maryland is one of the few states that impose both estate and inheritance taxes:

- Estate Tax: Applies to estates valued over $5 million (as of 2024), with rates up to 16%.

- Inheritance Tax: A flat 10% rate, but immediate family members are typically exempt.

Is Maryland Tax-Friendly for Retirees?

Maryland’s tax-friendliness for retirees is mixed:

Pros:

- No tax on Social Security benefits

- Generous pension exclusion for eligible retirees

- Military pension exemption

Cons:

- Presence of both estate and inheritance taxes

- Taxation of withdrawals from most retirement accounts

- Complex tax rules

FAQs

Governor Wes Moore’s 2025 Tax Increases

As part of his 2025 legislative agenda, Maryland Governor Wes Moore signed into law a series of tax changes that primarily affect higher-income earners and certain investment gains. These changes—set to take effect for tax years beginning after December 31, 2024—are aimed at addressing Maryland’s budget shortfall, simplifying the tax code, and shifting more of the tax burden to high earners.

Here’s a summary of what’s changing and what retirees need to know:

Personal Income Tax Changes

- New High-Income Brackets: Maryland is adding two new personal income tax brackets:

- 6.25% for taxable income over $500,000 ($600,001 for joint filers)

- 6.5% for taxable income over $1 million ($1.2 million for joint filers)

- 2% Capital Gains Surtax: A 2% surtax will apply to capital gains for taxpayers with federal adjusted gross income over $350,000. While this may sound like it targets the ultra-wealthy, many retirees selling appreciated assets could get caught in this net.

- Reduction in Itemized Deductions: Maryland is reducing itemized deductions by 7.5% of the amount by which your federal AGI exceeds $200,000. This can quietly erode deductions for medical expenses, charitable contributions, or mortgage interest—particularly for retirees living on substantial portfolio income.

- Higher Standard Deduction: To offset some of these changes, the standard deduction will increase to $3,350 for individuals and $6,700 for joint filers/head of households. Whether this truly balances out the loss of itemized deductions will depend on your situation.

- Local Income Tax Cap Raised: Maryland counties may now set local income tax rates as high as 3.30%, up from the previous 3.20% cap. This doesn’t mean rates are automatically going up, but it gives local governments more leeway to raise taxes in the future.

What Does This Mean for Retirees?

At first glance, you might assume these tax changes only impact the ultra-wealthy. But in practice, they could affect a broader group of retirees—especially those relying on taxable investment income, doing large Roth conversions, selling appreciated assets, or withdrawing substantial sums from IRAs or brokerage accounts.

The capital gains surtax and the reduction of itemized deductions both hit higher-income retirees squarely. And while the standard deduction is increasing, many retirees who’ve traditionally itemized may see their effective tax bill go up.

In short, these changes make proactive tax planning even more critical. Without a clear strategy, you may find yourself paying more than expected—and missing opportunities to control your tax bracket in retirement.

Tax Planning Strategies for Maryland Retirees

To optimize your retirement finances in Maryland, consider these strategies:

- Time your retirement account withdrawals: Spread out distributions to stay within lower tax brackets.

- Consider Roth conversions: Converting traditional IRA funds to a Roth IRA could save on future taxes.

- Leverage the pension exclusion: Understand how it applies to your situation and plan accordingly.

- Explore charitable giving: Donations can reduce your taxable income.

- Review your estate plan: Given Maryland’s estate and inheritance taxes, proper planning is crucial.

Conclusion and Next Steps

Understanding Maryland’s taxation of retirement income is essential for effective financial planning. While the state does tax many forms of retirement income, it also offers significant exclusions and exemptions that can benefit retirees.

To ensure you’re making the most of your retirement finances in Maryland:

- Review your current and projected sources of retirement income.

- Understand how each income source will be taxed.

- Explore strategies to minimize your tax burden.

- Consider consulting with a financial advisor familiar with Maryland’s tax laws.

At RCS Financial Planning, we specialize in helping retirees navigate Maryland’s tax landscape. Contact us today to schedule a consultation and optimize your retirement strategy.

Remember, tax laws can change, and individual situations vary. Always consult with a qualified tax professional or financial advisor for personalized advice.

Ted Toal is a Certified Financial Planner™ specializing in retirement income and tax planning for affluent professionals and business owners. With over 25 years of experience in wealth management, Ted helps clients transform retirement uncertainty into financial confidence through dynamic planning strategies.

This material is provided for educational, general information, and illustration purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing contained in the material constitutes tax advice, a recommendation for the purchase or sale of any security, or investment advisory services. This content is published by an SEC-registered investment adviser (RIA) and is intended to comply with Rule 206(4)-1 under the Investment Advisers Act of 1940. No statement in this article should be construed as an offer to buy or sell any security or digital asset. Past performance is not indicative of future results.